Monthly Recurring Revenue (MRR): a practical guide

In the world of SaaS, where recurring revenue is the lifeblood of a company, understanding and effectively managing your KPIs is crucial. Monthly Recurring Revenue (MRR) is among the most critical key performance Indicators. But do you fully grasp how MRR is calculated and what it reveals about your business? This comprehensive guide explains how to proceed while exploring why MRR is a fundamental element for analyzing performance and strategically managing a SaaS.

What is Monthly Recurring Revenue (MRR)?

MRR definition

Monthly Recurring Revenue (MRR) is a critical strategic KPI for SaaS companies operating on a subscription model. It measures the amount of predictable and recurring monthly revenue generated from active subscriptions. More specifically, MRR evaluates the monetary value of recurring revenue, taking into account three key elements:

- The number of subscribed customers: The size of your active subscriber base.

- The different plans and rates: The types of subscriptions you offer and their respective prices.

- The billing system: How revenue is structured and collected regularly.

Unlike monthly revenue, which may include non-recurring revenue such as activation fees or one-time sales, MRR focuses exclusively on recurring cash flows. This focus makes it a crucial indicator for assessing your SaaS business's long-term financial health and revenue stability.

Why is MRR so important?

MRR is more than just a financial indicator; it's a crucial barometer of your company's operational performance. It allows you to:

- Assess traction and growth: Tracking the evolution of MRR can help you identify growth trends, measure the effectiveness of your customer acquisition and retention strategies, and adjust your actions based on observed results.

- Forecast cash flow: Due to its recurring and predictable nature, MRR facilitates financial modeling and burn rate management, providing a reliable projection of future revenue.

- Analyze performance: MRR provides a solid foundation for evaluating complementary metrics such as churn rate, customer lifetime value (LTV), and customer acquisition cost (CAC), providing a comprehensive view of your company's financial and operational performance.

Difference Between MRR and Revenue

Revenue is a traditional accounting measure representing the total sales made over a specific period (month, quarter, year). It reflects completed transactions, sometimes including exceptional or non-recurring income.

MRR, on the other hand, is not a traditional accounting standard. It is not regulated by accounting frameworks and does not always match the revenue recognized within a given period. Instead, MRR is a projection of monthly recurring revenue from active subscriptions, providing a forward-looking view of expected regular income.

How to calculate MRR for your business?

Calculating Monthly Recurring Revenue (MRR) may seem simple but has several subtleties. Here's how to determine it, illustrated by a concrete example that clarifies the revenue difference.

MRR calculation formula

The basic formula for calculating a company’s MRR is as follows:

MRR = Number of Active Subscriptions x Monthly Amount of Each Subscription

Concrete Example

Let’s imagine that during a given month, your company has the following subscriptions:

- 15 monthly subscriptions, each at €120

- 5 annual subscriptions, each at €1,200

To calculate MRR, follow these steps:

- Calculate the monthly revenue from the monthly subscriptions:

Monthly Revenue = 15 subscriptions × €120 = €1,800 - Calculate the monthly revenue from the annual subscriptions by converting them to a monthly equivalent:

Monthly Amount per Annual Subscription = €1,200 ÷ 12 months = €100 - Then, multiply by the number of annual subscriptions:

Monthly Revenue = 5 subscriptions × €100 = €500 - Add the monthly revenues to obtain the total MRR:

MRR = €1,800 + €500 = €2,300

Thus, the MRR for this month is €2,300. This figure represents a stable projection of recurring revenue, unlike revenue, which can fluctuate based on non-recurring sales and exceptional income.

MRR Calculation Nuances and Options

While the basic MRR formula is relatively straightforward, several nuances must be considered to obtain an accurate and useful measurement.

Handling discounts, rebates, or allowances

Discounts may be granted during marketing campaigns or special offers to attract new subscribers. To calculate MRR optimally, it is recommended to exclude these discounts from the initial calculation to obtain a more accurate measure of gross recurring revenue. However, it may be helpful to adjust projections by integrating an average annual discount rate reflecting typical discounts granted for realistic financial forecasts.

Accounting for Churn

Churn, or attrition, represents the loss of MRR due to canceling or reducing subscriptions. You can integrate churn into the MRR calculation in two ways:

- At the unsubscribe date: Reduce MRR immediately at the time of cancellation to reflect the revenue loss as soon as it occurs.

- At the end of the subscription period: Consider churn at the end of the month or annual billing period, which can provide a smoother view of revenue losses.

MRR excluding or including taxes

Most SaaS companies calculate their MRR excluding taxes (excluding VAT), as VAT does not reflect the company's actual financial performance. However, there are two exceptions to this rule:

- VAT-Inclusive MRR for B2C Customers: For companies whose customers are individuals who cannot recover the VAT, it may be relevant to calculate MRR, including all taxes.

- Cash Flow Budget Calculation: Including VAT in the MRR calculation can refine cash flow forecasts by considering the amounts actually collected on monthly subscriptions.

{{discover}}

Why MRR is an essential KPI in SaaS?

Monthly Recurring Revenue (MRR) is much more than just a number for businesses: it's the thermometer of recurring growth and a key indicator for investors. From the very first subscriber, MRR becomes indispensable for navigating the ecosystem of recurring revenue. Here's why this KPI is crucial.

1. Alignment with the Recurring Revenue business model

In the SaaS world, where retention and recurring growth are vital, MRR is central. It allows companies to:

- Drive Growth: By monitoring the monthly evolution of MRR, startups can identify patterns of growth or churn, adjust their acquisition strategies, and optimize the LTV/CAC ratio.

- Track Profitability: MRR provides a granular view of stable revenues, which allows for evaluating the Product-Market Fit and calibrating acquisition and retention costs.

- Optimize Cash Flow Management: A precise MRR projection helps anticipate cash inflows and better manage the burn rate, which is critical for the startup’s runway.

2. Measurement of Contractual Recurring Revenue

MRR captures the contractual revenue already secured, providing a solid foundation for:

- Forecasting and planning: With MRR, companies can generate reliable revenue projections, which is crucial for business planning and board meetings.

- Building the financial model: MRR is the foundation for developing robust financial models, essential for pitch decks and discussions with VCs.

3. Key metric for investors and VCs

For investors, MRR is one of the main KPIs showing the SaaS model's traction and scalability. It is closely scrutinized to:

- Validate health metrics: Sustained MRR growth strongly signals a solid customer base and scaling potential.

- Evaluate market traction: VCs use MRR to measure market penetration and the effectiveness of acquisition strategies.

- Complement with other financial KPIs: Although central, MRR is often analyzed with other financial indicators such as gross margin, churn rate, and burn rate to obtain a complete overview of the company's performance.

💡Learn more: How to Maximize Your Communication with Investors?

How to track MRR evolution?

Analyzing MRR evolution provides a wealth of insights. It can lead a company to take corrective measures or review its commercial strategy. Here's how to analyze the different components of MRR over a given period:

- (+) New MRR: Revenue generated from acquiring new customers, a direct indicator of the effectiveness of your acquisition campaigns and go-to-market strategy.

- (+) Expansion MRR: Additional revenue from upsells or cross-sells when existing customers migrate to more expensive plans or purchase additional services. This reflects your product's ability to create additional value for your users.

- (+) Reactivation MRR: Revenue from customers who reactivate their subscriptions after inactivity. This is a sign that your reactivation strategies, such as email campaigns or special offers, are paying off.

- (-) Contraction MRR: Revenue decreases due to downgrades when customers switch to cheaper plans. This may signal dissatisfaction or adaptation to changing customer needs.

- (-) Churn: Revenue loss due to cancellations. Churn is often the most closely monitored KPI, as it can quickly erode growth if corrective actions are not taken.

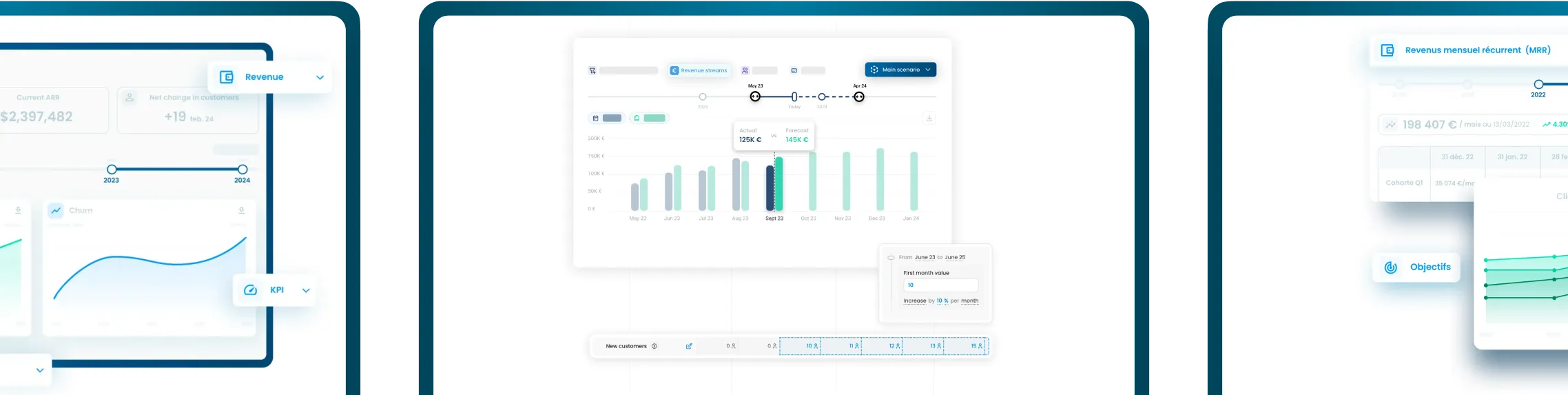

Monthly recurring revenue is an essential KPI for SaaS management. To integrate MRR into your reporting and track its evolution automatically, Fincome offers a reliable online solution connected to your applications. By using Fincome, you benefit from an automated dashboard that simplifies the management of your company's MRR data and provides real-time analytics for informed decision-making.

{{newsletter}}

Discover Fincome!

Frequently Asked Questions

Expense Tracking:

Fincome is a SaaS revenue management platform designed specifically for companies with recurring revenue models (any business selling subscriptions).

Fincome automates the tracking and management of your revenues and associated KPIs (churn, LTV, CAC, etc.) in real time, without the need for a data team or manual processing, thanks to direct integrations with your billing systems and ERP.

Unlike generic BI tools, Fincome offers a turnkey, intuitive solution tailored to the specific needs of subscription-based businesses, enabling seamless collaboration across your finance, GTM, and CSM teams.

Fincome is built exclusively for companies with recurring revenue models, meaning those that track MRR or ARR, such as:

• Software publishers (SaaS)

• Media companies

• Mobile apps

• Any other B2B or B2C subscription business looking to professionalize revenue management

Fincome supports organizations at every stage of growth, from startups to mid-market and large international enterprises.

With Fincome, you gain access to a full suite of modules:

✅ Revenue: detailed ARR/MRR breakdown, cohort analysis, detection of billing errors or omissions, revenue recognition and deferred revenue (PCA)

✅ Growth: analysis of ARR movements (new business, expansion, churn, reactivation), identification of growth drivers

✅ Unit Economics: LTV, CAC, and LTV/CAC analysis by segment, channel, or geography to optimize margins

✅ Retention: deep cohort analyses, identification of key retention drivers

✅ Renewals: future MRR projections, opportunity forecasting, and churn risk reduction

✅ Forecasting: revenue growth scenario modeling to better inform strategic decisions

Fincome is the only turnkey platform built specifically for recurring revenue businesses that combines:

✅ A complete, reliable view of your recurring revenues (MRR, ARR, churn, LTV, CAC, cohorts, renewals, revenue recognition, deferred revenue)

✅ Fully customizable, automated, shareable reports powered by AI, delivering actionable insights to guide your strategic decisions

✅ Expert support to help structure and interpret your analyses, without needing to build an internal data team

✅ The ability to generate future growth scenarios, compare them side by side, and track actual vs. forecasted performance, all in real time

Unlike traditional BI tools, which require you to build and maintain your own metrics (often consuming internal resources just to produce static data visualizations), Fincome transforms your SaaS metrics into concrete, actionable recommendations — helping you move faster, with more impact and operational efficiency.

Yes! If you use an unlisted or in-house billing system, no problem — you can easily import your billing data via Excel or push it through our public API. You can access our public API documentation here.

With Fincome, you can:

✅ Reduce up to 90% of the time spent calculating and reporting your KPIs

✅ Make faster, more accurate strategic decisions

✅ Recover up to 5% of lost revenue by detecting errors or omissions

✅ Cut the risk of manual spreadsheet errors by 80%

Absolutely. Data security is at the heart of what we do. Fincome is SOC 2 Type I certified, ensuring a high level of data security and protection.

Your data is collected exclusively via read-only APIs and hosted on secure servers located in France. We never share your data with third parties without your consent.

For a detailed review of our security practices, please visit our dedicated security page.

At Fincome, customer success is a core priority. We guide you from the very start — structuring your data, training your teams, and optimizing your use of the platform to deliver value quickly.

Our team remains by your side to answer strategic or technical questions, share best practices, and help you get the most out of your analyses.

Simply request a demo on our website. We’ll walk you through the platform, assess your needs, and guide you through a smooth deployment.

Most deployments and team trainings take no more than two weeks to get fully up and running.

👉 Request a demo

Income Analytics:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Budget Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Wealth Management:

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.

Lorem ipsum dolor sit amet consectetur adipiscing elit etiam vehicula. Etiam vehicula condimentum nunc, a semper elit luctus id. Duis fringilla enim non neque aliquet.